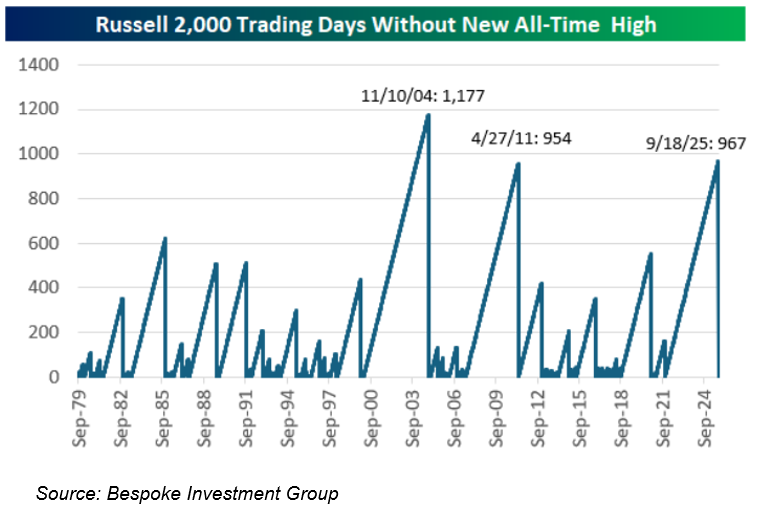

The chart of the week highlights periods when the Russell 2000, an index of U.S. small-cap stocks, went extended stretches without reaching a new all-time high. In September, the index finally broke through to a new high, ending its second-longest streak without one since the 1970s. Small caps posted a strong third quarter, boosted by the Federal Reserve’s September rate cut and growing expectations for additional easing. Rate cuts are particularly supportive for smaller companies, which tend to rely more heavily on debt to finance their operations. Small-cap stocks have faced notable headwinds in the past few years with higher interest rates and less exposure to technology-driven earnings growth, though it’s encouraging to see other areas of the equity market broaden out and participate in new highs.