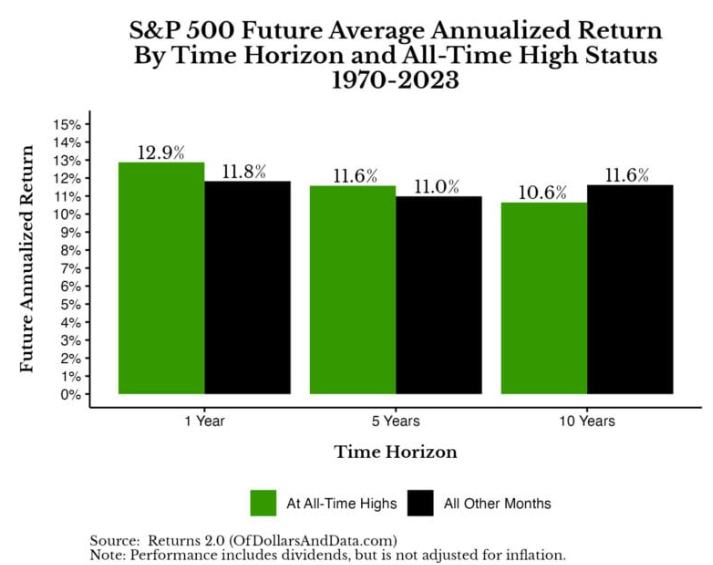

The chart of the week looks at the returns of the S&P 500 after it reaches an all-time high. As we have recently reached a new all-time high on the S&P, we tend to get a lot of questions regarding it being a bad time to invest. But, as the chart shows over a 1 and 5-year period, investing at the all-time high has historically given a higher return than investing on days when the S&P did not reach an all-time high. This is likely due to the momentum in the market, and all-time highs tend to come in bunches. However, over 10 years, investing in days that are not at an all-time high has outperformed by about 1%. Two main takeaways: First, just because we are at market highs does not mean it is a bad time to invest. Second, the average return for both market highs and non-market highs has been over 10%. So, if your time frame and risk tolerance match, the stock market has been a great investment over the last 53 years.