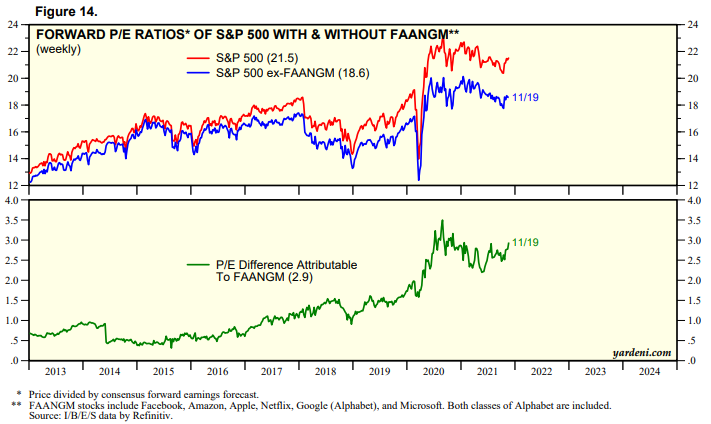

Equities remain expensive based on various metrics, with the forward P/E for the S&P 500 over 26% above the 25 year average. While that does leave the equity market vulnerable to a correction, a further look suggests that equities may not be as expensive as they first appear. For example, this week’s chart of the week shows the Forward P/E for the S&P 500 with and without FAANGM (Facebook, Apple, Amazon, Netflix, Google, and Microsoft). The reason you would consider removing these companies from the assessment is their earnings are growing at a faster rate, they are less capital intensive, and together they account for over 25% of the S&P 500. If those companies are removed from the measure, the forward P/E drops to 18.6. While that still leaves the balance of the S&P 500 roughly 10% overvalued, that’s not necessarily surprising given accommodative monetary policies from the Fed, low bond yields, and where we are in the business cycle.

Source: Yardeni