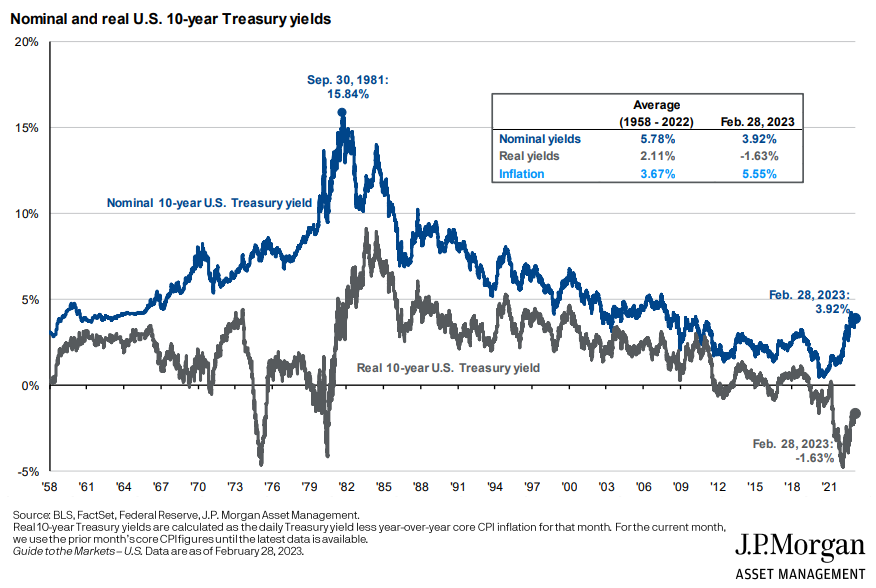

The chart of the week looks at both nominal 10-year Treasury and real (which is nominal minus inflation) yields since 1958. The average real yield over that time period was 2.11% and currently the real yield is negative 1.63%. This has increased recently as inflation has slowed and rates continue to move higher. Prior to that, the real yield hit a low not seen since the early 1980s. From an investment perspective, while a 3.92% 10-year Treasury yield is much more attractive than it has been, what really matters is the real yield. For real yields to move positively, rates will have to continue to move higher and/or inflation will have to continue to slow down. Negative real yields have not historically been a persistent phenomenon.