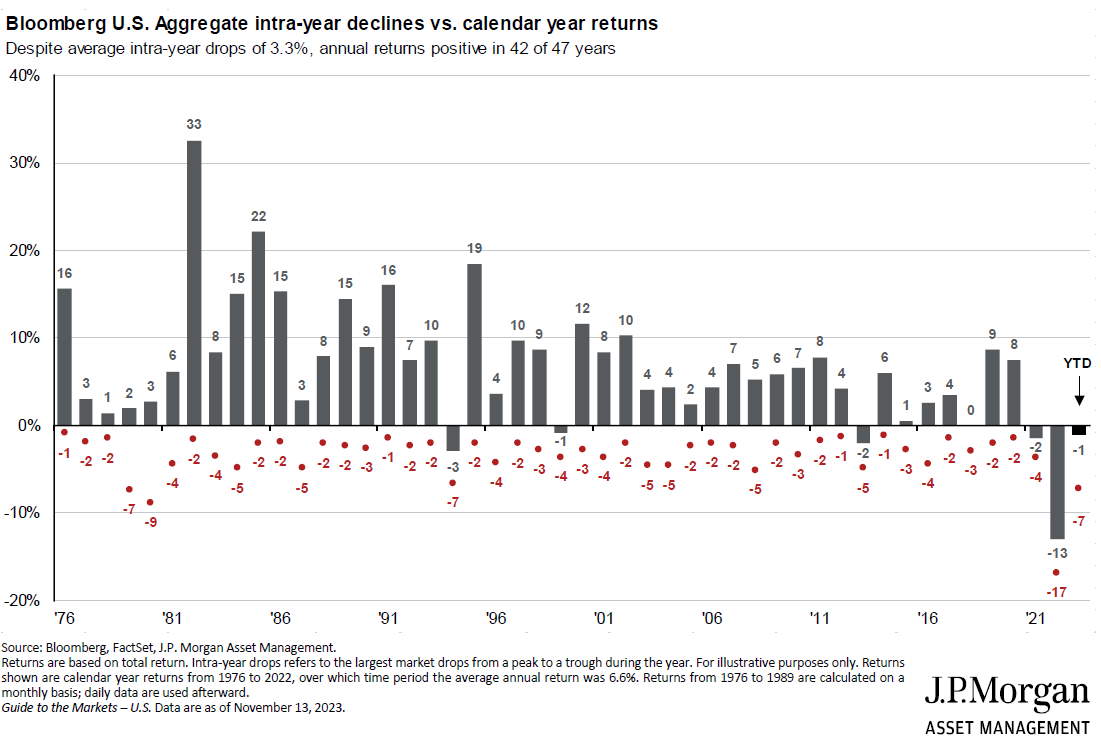

The chart of the week looks at the annual returns for the Barclays U.S. Aggregate Bond Index since 1976. As of November 13, the index is on pace for its third consecutive negative calendar year return in a row, which would be only the sixth negative return for the index since 1976. While many think increasing interest rates are good for bond investors, and it will be moving forward, as interest rates increase, the prices of bonds you currently hold will fall, which will create the potential negative return for 2023. While this is historic, should bond yields stabilize or even decrease, the higher starting yields for bonds across the board should be welcomed by investors moving forward.