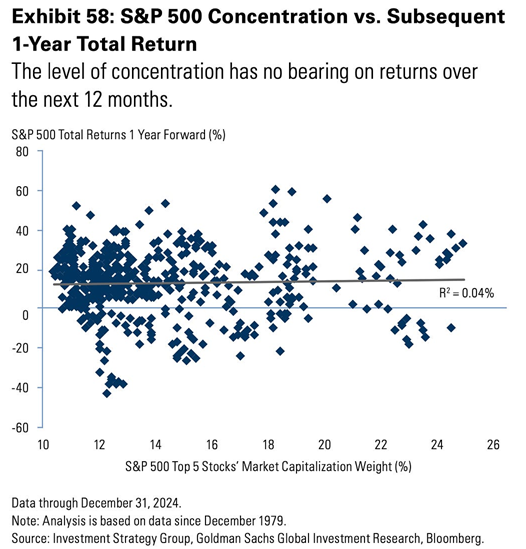

Our chart of the week examines concentration of the S&P 500’s five largest holdings and their relationship to one-year forward returns. In recent years, there’s been considerable debate as mega-cap technology stocks have delivered strong performance and grown to represent a larger share of major U.S. equity indexes. While higher stock concentration can increase risk, history shows a weak/non-existent correlation between concentration levels and short-term returns. The key takeaway: focus on maintaining a balanced approach and keeping portfolios aligned with long-term objectives, rather than letting market concentration headlines steer your investment strategy.