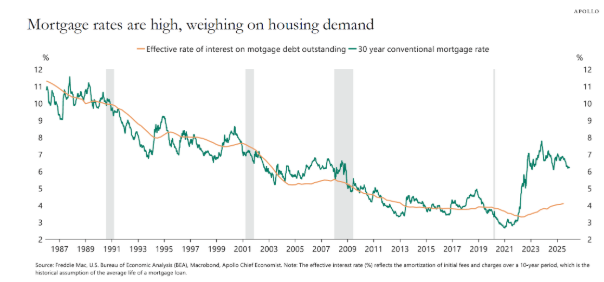

The chart of the week shows that mortgage rates remain elevated relative to the past decade, which continues to weigh on housing demand by keeping monthly payments high. While rates have come down from their recent peak, they are still well above the levels that supported strong home sales from 2012–2021. The gap between today’s mortgage rates and the effective rate on outstanding mortgages also highlights the lock-in effect, where existing homeowners are reluctant to sell and give up lower-rate mortgages. For home sales to meaningfully increase, mortgage rates likely need to fall further, or household incomes must rise enough to restore affordability. Additionally, more housing inventory, either from new construction or existing owners re-entering the market, would be needed to translate improved affordability into higher transaction volumes.