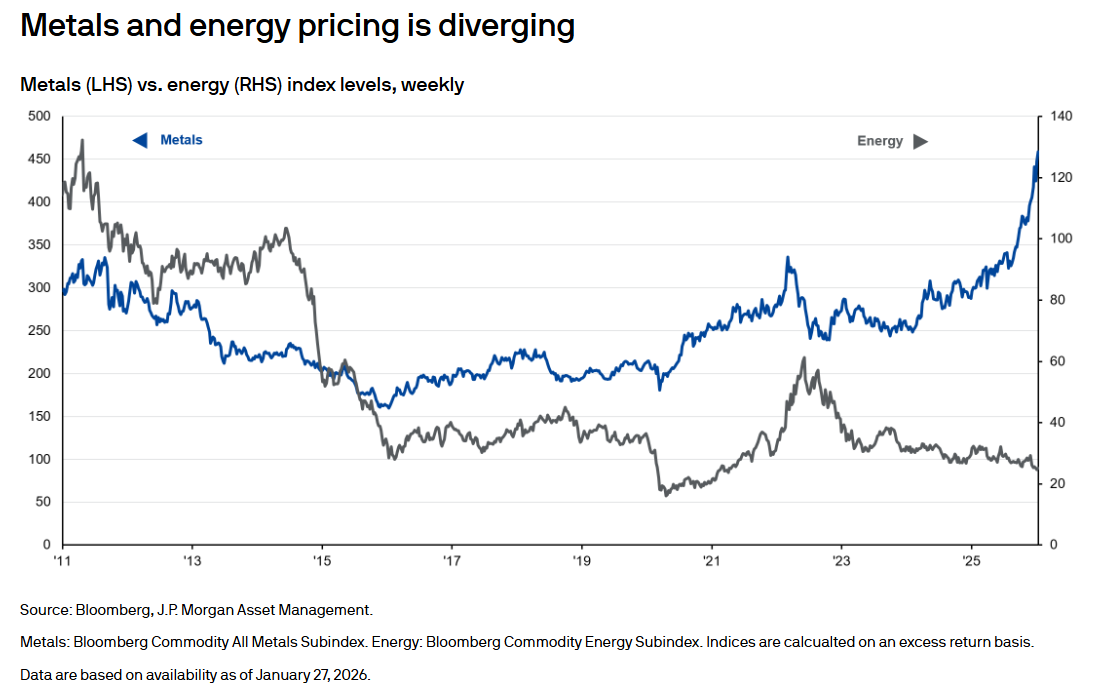

This week’s chart highlights a growing divergence between industrial/precious metals and energy prices. These commodity‑related investments have generally moved in the same direction for much of the past decade, but that trend has shifted recently. Metal prices have climbed as supply remains constrained given the long lead times, high capital requirements, and regulatory hurdles associated with bringing new mining capacity online, and recent disruptions relating to natural disasters and labor issues have kept production of key metals like copper tight. Meanwhile, demand continues to rise, supported by the energy transition, AI data‑center expansion, and ongoing central bank gold purchases. Energy tells the opposite story: oil supply has expanded meaningfully due to technological advancements and rising U.S. production, outpacing still‑steady petroleum demand. Both markets remain sensitive to shifts in growth, policy, and geopolitics, meaning today’s divergence could quickly change within these volatile asset classes.