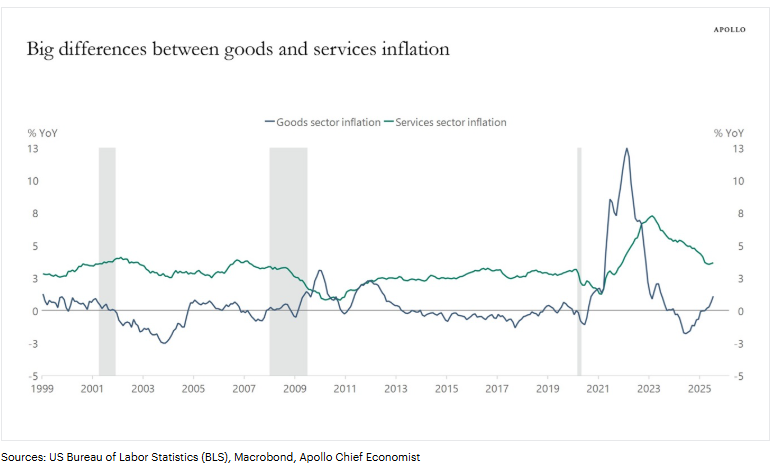

This week’s chart breaks down inflation trends across the goods and services sectors of the U.S. economy. Services inflation, shown in green, remains elevated relative to its 20-year average but has been steadily declining—driven by cooling wage growth and easing housing inflation. In contrast, goods inflation, depicted in dark blue, has become a growing challenge for the Federal Reserve. The evolving impacts of tariffs have pushed goods prices higher in several categories, while a weakening U.S. dollar has further amplified this effect by increasing the cost of goods sourced internationally. The silver lining for investors is that longer-term inflation expectations remain well-anchored, supporting optimism around potential rate cuts later in 2025.