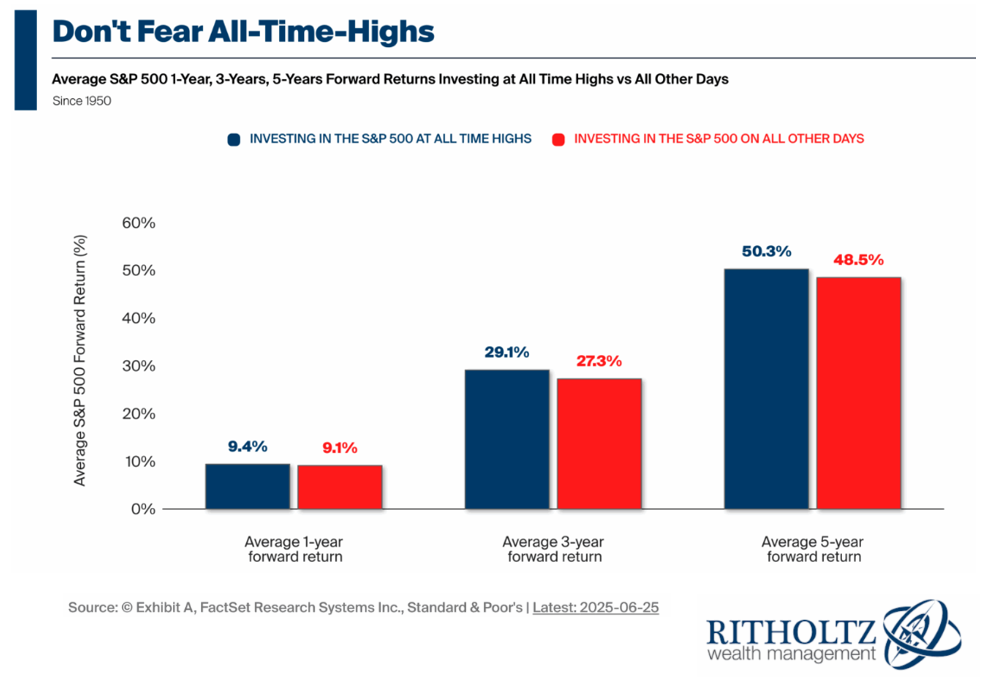

This week’s chart looks at the average 1, 3, and 5-year forward returns of the S&P 500 following all-time highs. The data highlights a counterintuitive but important insight: investing in the U.S. equity market at all-time highs has historically outperformed investing on randomly selected days. New highs often occur during strong bull markets and tend to confirm underlying strength and momentum in the corporate sector. With a long-term perspective, buying at all-time highs has proven to be a positive and effective strategy, as opposed to a red flag for investors.