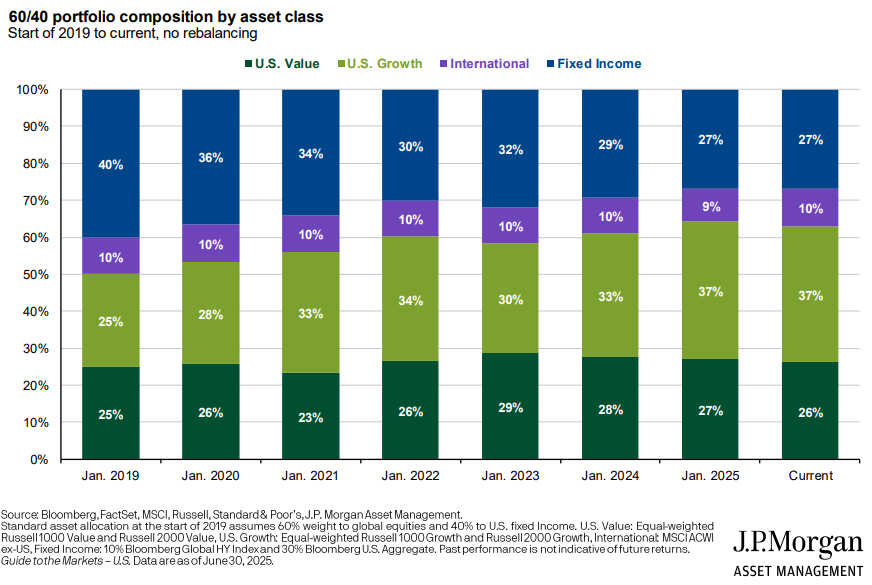

The chart of the week illustrates the changing composition of a portfolio consisting of 60% equities and 40% fixed income, focusing on asset classes from January 2019 to June 2025. Over this period, the allocation has shifted due to market movements, with equities significantly outperforming fixed income and a notable rise in US growth stocks. As a result, fixed income has decreased from 40% to 27%, while US growth equities have increased impressively from 25% to 37%. This shift has created a much more aggressive portfolio than the one established in 2019, which is now composed of 73% equities and 27% fixed income. This could mean a lot more risk for those investors who follow a “set it and forget it” mindset. With markets hovering at or near all-time highs and fixed income yields appearing fairly attractive, this may be an ideal time to review your portfolio for potential rebalancing. However, bear in mind that for taxable portfolios, any rebalancing may have tax implications.