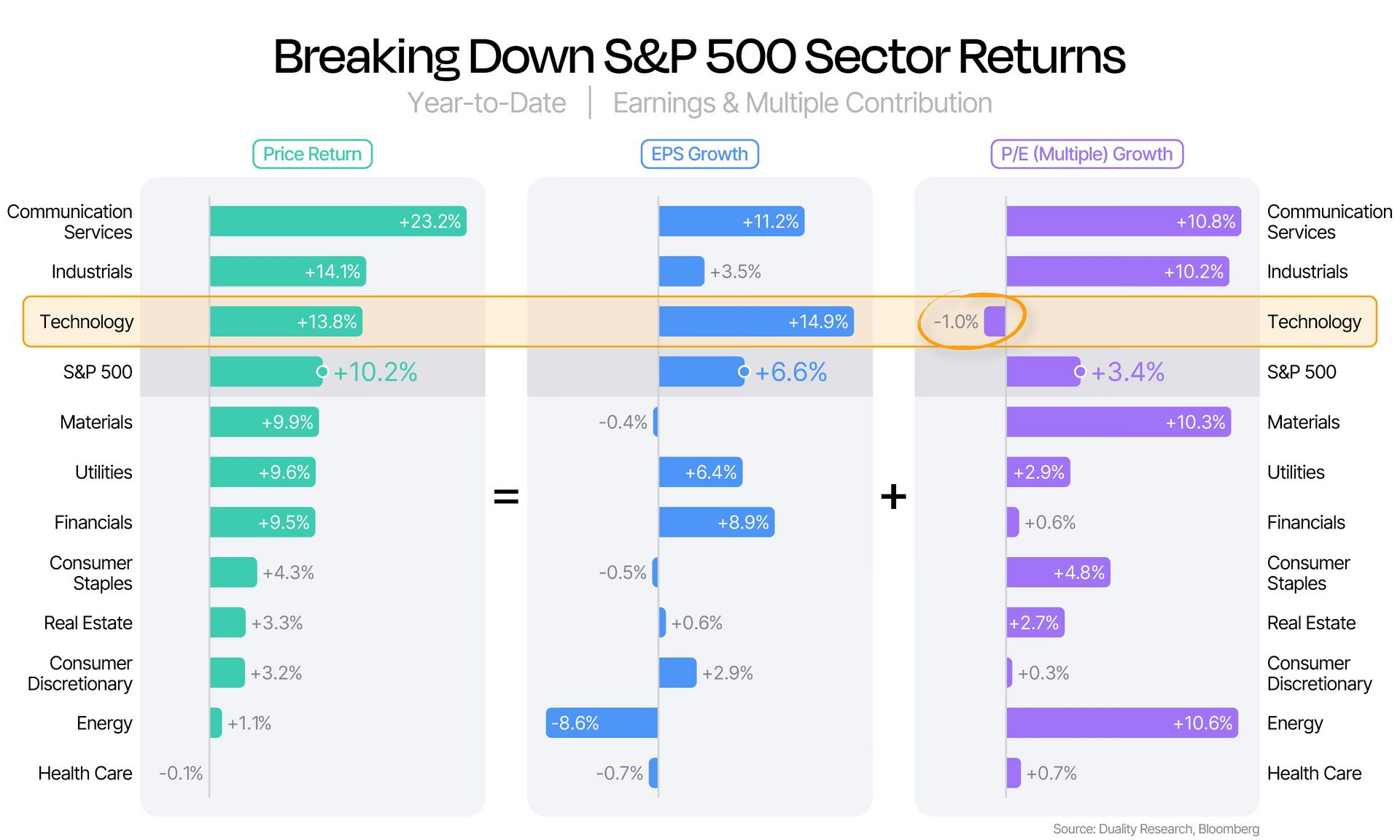

This week’s chart breaks down the year-to-date (YTD) price return of the S&P 500 by analyzing the contributions from earnings growth and valuation (P/E multiple) expansion across sectors. While the index’s overall P/E remains elevated compared to historical norms, most of the return in 2025 has been driven by earnings per share growth. Notably, the technology sector—closely tied to AI enthusiasm—has seen its YTD price appreciation primarily fueled by earnings rather than investors paying higher multiples. In contrast, cyclical sectors like materials, real estate, and energy have experienced flat or negative earnings growth, yet still posted positive returns due to multiple expansion. At current valuations, continued earnings growth will be essential for the broader index to sustain its upward momentum.