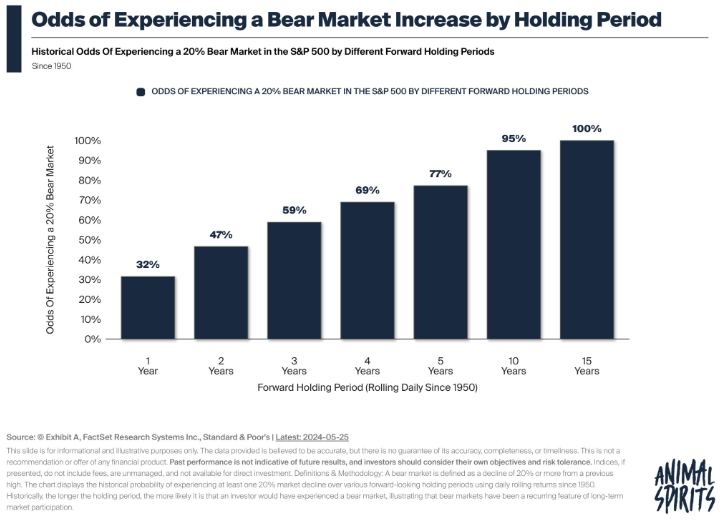

The chart of the week explores the likelihood of encountering a bear market, defined as a 20% decline in the S&P 500, based on your investment holding period. Since 1950, anyone invested in the S&P 500 over a 15-year period has experienced at least one bear market, a 100% probability looking backward. Even with a shorter 5-year investment horizon, there was a 77% chance of facing a bear market.

The key takeaway: Bear markets are not a matter of if, but when. They are an inevitable part of long-term investing, which is the length of time that normally works best. This doesn’t mean you need to take a more tactical approach or react with worry. Instead, it’s about setting the right expectations and being prepared to stay the course through inevitable downturns.